Polymer Foam Market Size | Companies Analysis 2025- 2034

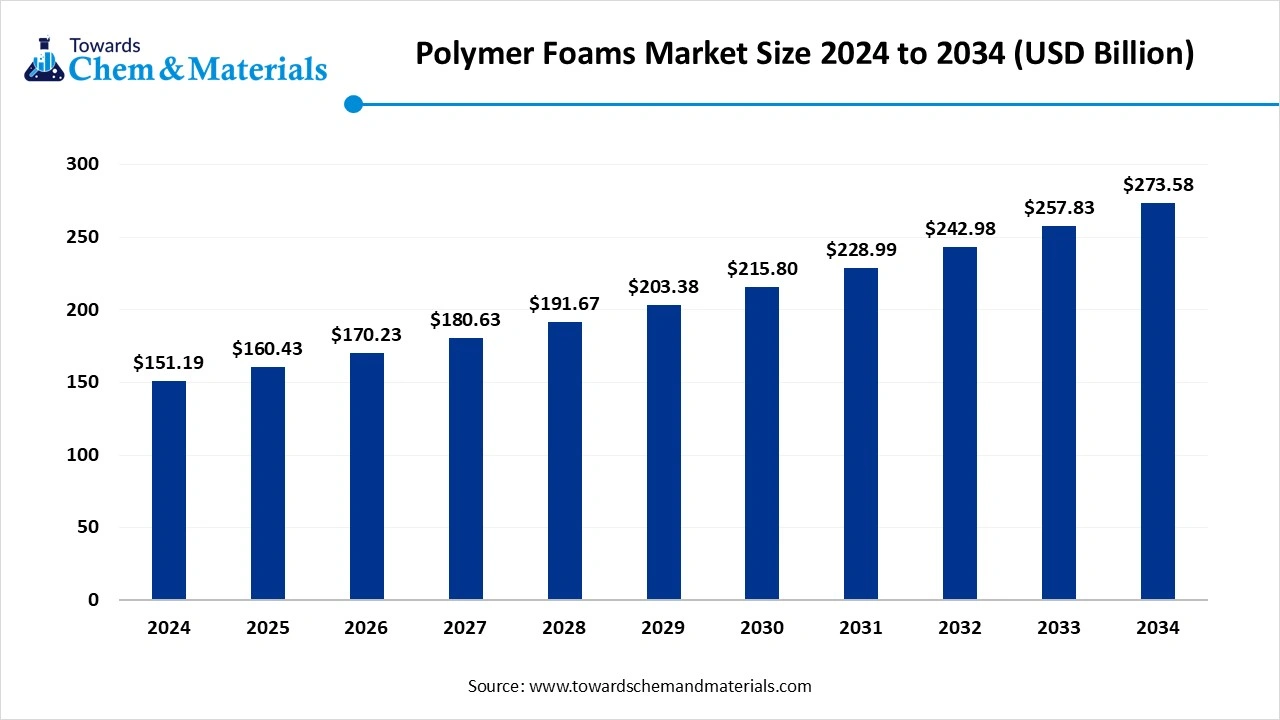

According to Towards Chemical and Materials, the global polymer foam market size is calculated at USD 160.43 billion in 2025 and is expected to be worth around USD 273.58 billion by 2034, growing at a CAGR of 6.11% from 2025 to 2034. The key market players identified in the report are Arkema Group; Armacell International S.A; BASF SE; Borealis AG; Fritz Nauer AG; Koepp Schaum GmbH; JSP Corporation; Polymer Technologies; Inc.; Recticel NV; Rogers Corporation; SEKISUI ALVEO AG; Synthos S.A.; DowDuPont; Inc; Trelleborg AB; Zotefoams plc; Woodbridge Foam Corporation; Sealed Air Corporation

Ottawa, Nov. 03, 2025 (GLOBE NEWSWIRE) -- The global polymer foam market size was valued at USD 151.19 billion in 2024 and is anticipated to reach around USD 273.58 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.11% over the forecast period from 2025 to 2034. Asia Pacific dominated the polymer foam market with a market share of 45% in 2024. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5901

What is Polymer Foam?

The polymer foam market is driven by increasing demand for materials that offer lightweight insulation, cushioning, and durability in sectors such as packaging, automotive, and construction. Innovations in energy efficiency, sustainability, and material performance are shaping the industry, with manufacturers focusing on bio-based formulations, recyclable thermoplastics, and new foam architectures. Geographically, the Asia Pacific region is the major market hub, driven by large-scale industrialization, infrastructure growth, and increasing production capacities. On the application side, building and construction remains a key end-use domain for polymer foams due to insulation needs and structural benefits, while packaging and automotive sectors continue to expand their foam usage for lightweighting, protection, and design flexibility. Technologically, trends such as closed-cell and open cell foam structures, and flexibility. Technologically, trends such as closed cell and open cell foam structures, flexible versus rigid foams, and a variety of resin types are enabling the market of diversify and cater to more specialized requirements.

Polymer Foam Market Report Highlights

- The Asia Pacific Polymer Foam market held the largest share of 45% of the global market in 2024.

- By foam type, the rigid foam segment held the highest market share of 55% in 2024.

- By resin type, the polyurethane foam segment held the highest market share of 40% in 2024.

- By cell structure, the closed-cell foam segment held the largest revenue share of 65% in 2024.

- By application, the building & construction segment held the largest market share of 35% in 2024.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5901

Polymer Foam Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 170.23 billion |

| Revenue forecast in 2034 | USD 273.58 billion |

| Growth rate | CAGR of 6.11% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Foam Type, By Resin Type, By Cell Structure, By Application, By Region |

| Regional scope | North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

| Key companies profiled | Arkema Group; Armacell International S.A; BASF SE; Borealis AG; Fritz Nauer AG; Koepp Schaum GmbH; JSP Corporation; Polymer Technologies; Inc.; Recticel NV; Rogers Corporation; SEKISUI ALVEO AG; Synthos S.A.; DowDuPont; Inc; Trelleborg AB; Zotefoams plc; Woodbridge Foam Corporation; Sealed Air Corporation |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Polymer Foams—Properties and Processing Technologies

Structural properties of polymer foams

Polymer foams have unique physical, mechanical and thermal properties, which are mostly influenced by the characteristics of the polymer matrix, the distributed gas bubbles, and their relationship. This relation affects the produced cell structure, which can be described by cell density, expansion rate, average cell size, and cell type. By using these properties, we can classify the polymer foam products in several ways based on their type of structure, average cell size, porosity or density.

Porosity is widely used for the classification of different porous materials, which can be calculated as the ratio of the pore volume and the total volume of the foam material (see Equation ):

where (–) is the porosity, Vpore (m3) is the pore volume in the foam, while Vtotal (m3) is the total volume of the foam material. In addition to several other porous materials (such as ceramics and metals), porosity is also often used to characterize polymeric foam structures. It gives supplementary information about the homogeneity of the foaming process and can explain tendencies in the mechanical properties. If the exact volume of a foam sample is unknown, different two-dimension imaging techniques are used to determine the porosity and investigate the morphological properties (e.g, pore types).

Generally, three main pore types are distinguished in the literature based on the accessibility to the surface of the porous material, closed pores, blind pores, and through pores. Closed pores are completely separated from the material surface; blind pores can be accessed from the surface, but they ends inside the materials, while through pores connect the inner and outer material surfaces.

What are the Key Applications of Polymer Foams?

- Construction: Rigid polymer foams, like expanded polystyrene (EPS) and polyurethane (PU) foam, are used for high-performance thermal insulation in walls, roofs, and foundations to improve building efficiency and reduce energy costs.

- Automotive: Flexible and rigid foams are integrated into vehicles for seat cushioning, interior trim, sound insulation to reduce noise, vibration, and harshness (NVH), and for lightweight structural components to improve fuel efficiency.

- Packaging: Lightweight foams provide essential cushioning and shock absorption for protecting fragile items during transit and are also used for thermal insulation in cold chain packaging.

- Furniture and bedding: Flexible polyurethane foam is the primary material used for comfort and support in mattresses, sofas, chairs, and other upholstered furniture.

What are the Major Trends in the Polymer Foam Market?

- A strong shift toward eco-friendly and recyclable foam solutions, with the development of bio-based polyols, water foams, and recyclable thermoplastic foams.

- Expansion of manufacturing capacities in high growth regions such as the Asia Pacific and the Middle East to meet increasing regional demand and global trade flows.

- Rising use of foam materials in light weighting, insulation, cushioning, and durability applications across sectors such as automotive, packaging, and construction.

- Advances in foam architecture and cell-structured design, and broader resin choices enables more specialized end-use performance.

- Intensified regulatory and sustainability pressure is pushing foam producers to change raw material sourcing, blowing agent technologies, and end-of-life recyclability practices.

How Does AI Influence the Growth of the Polymer Foam Industry in 2025?

AI is playing an increasingly influential role in shaping the growth of the polymer foam Industry in 2025 by accelerating innovation, improving efficiency, and enhancing sustainability. For one, AI-driven simulations and predictive modelling allow manufacturers to optimise foam formulations much faster than traditional trial and error methods, so materials can be tailored to specific performance requirements such as thermal insulation, density, durability, or impact resistance. In manufacturing operations, AI-powered systems enable real-time monitoring and predictive maintenance of foaming equipment, reducing downtime and minimising waste, which lowers production costs and supports higher throughput. Furthermore, as sustainability becomes a major driver, AI is helping identify and test bio-based raw materials and recyclable foam formulations by analysing large datasets of material properties, speeding development of greener foams and assisting producers in meeting regulatory and consumer demands.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5901

Polymer Foam Market Dynamics

Growth Factors

Can Light weighting Revolutionize Vehicle Design?

Automakers are increasingly using polymer foams to reduce vehicle weight and improve energy efficiency. Their strength-to-weight advantage makes them ideal for interiors, insulation, and electric vehicle components. This shift is fuelling demand for advanced foams that balance durability with low density.

Is Sustainability Shaping the Future of Foams?

The move toward bio-based and recyclable foams is gaining traction as industries seek eco-friendly materials. New cellulose-based foams that can be recycled like paper highlight this shift toward greener alternatives. This sustainability focus is expanding opportunities for innovative polymer foam solutions.

Market Opportunity

Can Recycle foams Transform Packaging?

Recyclable polymer foams are emerging as a major opportunity in sustainable packaging. Companies like Borealis are developing lightweight, mono material foams that meet circular-economy goals and cut waste. As brands seek eco-friendly materials, demand for such foams in e-commerce and consumer goods is growing fast.

Will Lightweight Foams Reshape Mobility and Building?

Lightweight polymer foams are gaining traction in automotive and construction for their strength and insulation benefits. Innovations in ultra-light foams help reduce energy use while improving durability and comfort. This creates strong growth potential for producers focused on advanced, energy-efficient foam materials.

Limitations & Challenges

- The industry is facing mounting regulatory and sustainability pressure as many foams are derived from petroleum based raw materials and present challenges in end of life disposal and environmental impact.

- Volatility in raw material prices and supply chain disruption are placing a strain on profitability and investment, thereby restricting expansion and innovation for many foam producers.

Polymer Foam Market Segmentation Insights

Foam Type Insights:

Which Foam Type Dominated the Polymer Foam Market in 2024?

The rigid foam segment dominated the market, with s share of 55% in 2024. Rigid polymer foams continue to dominate because their structural strength, insulation performance, and durability make them especially suitable for building and construction, cold chain, and infrastructure applications where long-term performance is critical. The preference for foams that provide thermal and mechanical stability, combined with their widespread use in exterior insulation panels, roofing systems, and industrial applications, reinforces the dominance and cost effectively in heavy use environments and infrastructure projects where replacement cycles are longer and reliability is key. Advances in blowing agents, fire-retardant additives, and dimensional stability are making rigid foams even more appealing for large-scale applications.

The flexible foam segment is expected to grow with the highest CAGR in the market during the studied years. Flexible foams are gaining momentum due to their versatility, light weight, and suitability for applications like seating, bedding, automotive interiors and protective, packaging where comfort, shock absorption, and ergonomics matter. As consumer demand for comfort increases, vehicle manufacturers seek lighter, more adaptive interior materials and packaging firms look for cushioning solutions that protect goods and reduce transport weight. This drives flexible foam uptake.

Resin Type Insights:

Which Resin Type Is Dominating The Polymer foam Market?

The polyurethane foam segment dominated the market in 2024, with a share of 40%. Polyurethane (PU) foam remains dominant because it offers exceptional versatility, being available in both rigid and flexible forms and covering applications from insulation and structural panels to seating and bedding. Its cost-performance trade-off, combined with well-established production technologies, makes it the go-to choice for many foam applications. The dominance is reinforced by extensive industry familiarity, global supply chains, and an engaging history that supports large-scale deployment. Manufacturers also favour polyurethane foams when tailored mechanical or thermal properties are required, such as heavy-duty insulation or resilient seating.

The polyolefin foam segment is projected to experience the highest growth rate in the market between 2025 and 2034. Polyolefin foams are seeing rapid uptake due to their recyclability, chemical resistance, and sustainability for lightweight protection and packaging applications where environmental credentials are increasingly important. As end-users and regulators push for sustainable, low-impact materials, polyolefin foams offer a compelling value proposition of lower density, cost efficiency, and easier recoverability/ recycling compared to some traditional resins.

Cell Structure Insights:

Which Cell Structure Dominates the Polymer Foam Market?

The closed-cell foam segment dominated the market in 2024, with a share of 65%. Closed-cell foams dominate because their dense structure offers superior barrier properties, compressive strength, dimensional stability, and moisture resistance, critical traits for insulation panel, floatation devices, structural components, and cold chain logistics. Industries that demand long service life, durability under load, and low thermal conductivity naturally gravitate to closed-cell foams, reinforcing their dominance. The manufacturing maturity of closed cell technologies, along with their integration into building and industrial systems, supports wide adoption.

The open cell foam segment is expected to expand rapidly in the market in the coming years. Open cell foams are gaining traction due to their lighter weight, breathability, acoustic dampening, and flexibility, making them well-suited for applications in furniture, acoustic insulation, mattress cores, packaging inserts, and automotive interiors where comfort and sound attention matter. As consumer goods and automotive interiors place greater emphasis on acoustic performance, comfort, and design flexibility, open cell forms fulfil these needs and unlock new usage scenarios.

Application Insights:

Which Application Is Dominating The Polymer Foam Market?

The building and construction segment dominated the market, with a share of 35% in 2024. Building and construction applications dominate because polymer foams are key to achieving better thermal insulation, energy efficiency, acoustic control and lightweight structural components in homes, commercial buildings and industrial facilities. The push for green building, retrofit insulation, and stricter building codes makes foams an essential component of construction systems, particularly rigid types used in panel insulation, roofing, and wall assemblies. The scale and long lifecycle of construction projects also favour foam materials that materials that deliver durability, thermal performance, and low maintenance. Combined with global infrastructure growth and heightened sustainability emphasis, this application domain remains the biggest contributor to polymer foam demand. The large volume, system integrated nature of construction work ensures that building and construction will stay as the dominant application for polymer foams.

The automotive segment is projected to grow with the highest CAGR in the market during the forecast period. The automotive application segment is accelerating because of the increasing focus on lightweighting, interior comfort, noise and vibration management, and insulation for electric vehicle battery modules, all of which rely on advanced polymer foams. Vehicle manufacturers are adopting specialized foam grades for seating comfort, thermal management of EVs, impact protection, and acoustic damping, creating new pathways for foam producers. As mobility moves toward electric vehicles, shared ride models, and premium comfort interiors, the foam requirements become more stringent and diversified, opening growth avenues. Furthermore, packaging within automotive supply chains adds another dimension to foam application in mobility.

Regional Insights

The Asia Pacific polymer foam market size was valued at USD 68.04 billion in 2024 and is expected to surpass around USD 123.28 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.12% over the forecast period from 2025 to 2034.

Asia Pacific region dominated the market in 2024, with a share of 45%, because rapid urbanisation, booming infrastructure build-out out and rising demand in construction, packaging, and automotive sectors are driving foam consumption. Manufacturers are expanding capacity in countries like India, China, and Southeast Asia to capitalise on lower costs, strong manufacturing ecosystems, and growing end-use markets. The result is a regional ecosystem where polymer foam production, demand, and application development reinforce one another, keeping the region in a dominant position.

China Polymer Foam Market Trends

China plays a pivotal role within the Asia Pacific market due to its massive construction and automotive industries, which create very high demand for foam materials used in insulation, vehicle interiors, and packaging. Furthermore, strong governmental support for manufacturing, infrastructure expansion, and sustainability driven regulations helps foams become integrated into Chinese industrial strategies. This concentrated demand for strategic alignment makes China a central growth engine in the market.

Why Is Latin America Emerging As The Fastest Growing Region For Polymer Foam?

Latin America is projected to expand rapidly in the market in the coming years. Latin America is creating strong momentum for polymer foams used in insulation, wall panels, and construction applications. The rise of automotive manufacturing, furniture production, and packaging industries is also contributing to heightened demand for foam solutions in Latin America. Relatively untapped markets and infrastructure upgrade cycles in countries such as Brazil and Mexico offer foam producers opportunities to expand and establish a local presence.

Brazil Polymer Foam Market Analysis

Brazil dominates the regional market, largely because it is the region's biggest economy with the largest construction, automotive, furniture and packaging sectors (all heavy users of polyurethane, polystyrene and other foams), a well-developed domestic manufacturing base and growing demand for energy-efficient insulation and protective packaging, local raw-material supply chains, investments in PU/foam capacity, and faster urbanization & e-commerce growth have helped Brazil capture the largest revenue of the market.

Top Companies in the Polymer Foam Market & Their Offerings

- BASF SE: This global chemical company offers a comprehensive range of innovative polyurethane foam solutions, including flexible and rigid foams, for the automotive, construction, and electronics sectors.

- The Dow Chemical Company: Dow provides advanced foam additives, polyols, and other specialty chemicals for the production of flexible and rigid polyurethane foams used in appliances, automotive, and building and construction markets.

- Huntsman Corporation: Huntsman specializes in MDI-based polyurethane systems, delivering tailored rigid and flexible foam solutions for diverse applications such as insulation, automotive parts, and footwear.

- Recticel S.A.: Formerly a producer of a wide range of polyurethane engineered foams for industrial and comfort applications, Recticel divested its Engineered Foams business to Carpenter Co. in 2021.

- Rogers Corporation: Rogers Corporation provides high-performance, specialty polyurethane and silicone foam materials, such as its PORON line, for sealing, gasketing, cushioning, and impact protection, primarily for the electronics and automotive industries.

- Sealed Air Corporation: The company produces engineered polyethylene foam products, including planks and rolls, under brands like Ethafoam and Stratocell, for protective packaging and specialty uses.

- Borealis AG: Borealis provides advanced polyolefin foam solutions, including Daploy high melt strength polypropylene, for lightweight applications in the packaging, automotive, and construction sectors.

- Exxon Mobil Corporation: Exxon Mobil offers Achieve Advanced polypropylene resins that are designed to be easily foamable for applications such as lightweight automotive parts, durable packaging, and building insulation.

- Finproject Group: Finproject produces a wide range of thermoplastic compounds, including special polyolefin-based foam compounds like XL EXTRALIGHT®, for industries such as footwear, automotive, and packaging.

- Hanwha Solutions Chemical Division: The company supplies basic petrochemical products, including TDI for polyurethane foam production and EVA for specialty products like shoe soles and solar cell sheets.

- JSP Corporation: JSP is a key manufacturer specializing in expanded polypropylene (EPP) particle foams under the ARPRO brand, which are used for lightweighting and impact energy absorption in automotive, packaging, and construction applications.

- Kaneka Corporation: Kaneka manufactures various polymer foams, such as EPERAN polypropylene foam and biodegradable Green Planet™ molded foam products, used for insulation, packaging, and eco-friendly containers.

- SABIC: SABIC provides lightweight foam solutions based on polyolefin materials for the automotive industry to aid in fuel efficiency, as well as for energy-efficient insulation in building and construction.

- Sekisui Chemical Co., Ltd.: Sekisui is a leading producer of cross-linked polyolefin foams, including the SOFTLON series, which are used for applications requiring superior thermal insulation, shock absorption, and sealing properties.

-

Trocellen GmbH: Trocellen manufactures chemically and physically cross-linked polyolefin foams, offering a range of lightweight products for thermal insulation, acoustics, automotive interiors, and packaging

More Insights in Towards Chemical and Materials:

- Polymers Market : The global polymers market size was reached at USD 796.53 billion in 2024 and is expected to be worth around USD 1,351.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.43% over the forecast period 2025 to 2034.

- Biopolymers Market : The global biopolymers market size was valued at USD 19.85 billion in 2024, grew to USD 21.93 billion in 2025, and is expected to hit around USD 53.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.46% over the forecast period from 2025 to 2034.

- Polymer Chameleon Market : The global polymer chameleon market size was reached at 453.18 million in 2024 and is expected to be worth around USD 1,225.52 million by 2034, growing at a compound annual growth rate (CAGR) of 10.46% over the forecast period 2025 to 2034.

- Liquid Crystal Polymers Market : The global liquid crystal polymers market size was valued at USD 1.99 billion in 2024, grew to USD 2.25 billion in 2025, and is expected to hit around USD 6.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.95% over the forecast period from 2025 to 2034.

- Bioresorbable Polymers Market : The global bioresorbable polymers market volume accounted for 1,121.0 kilotons in 2024 and is predicted to increase from 1,267.9 kilotons in 2025 to approximately 3,839.1 kilotons by 2034, expanding at a CAGR of 13.10% from 2025 to 2034.

- Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

- Fluoropolymers Market : The global fluoropolymers market volume was valued at 639.21 kilo tons in 2024 and is expected to reach around 1351.23 kilo tons by 2034, growing at a CAGR of 7.77% from 2025 to 2034.

- Polymer Modified Bitumen Market : The global polymer modified bitumen market volume was valued at 25.70 million tons in 2024 and is expected to hit around 39.90 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.50% over the forecast period 2025 to 2034.

- Fiber Reinforced Polymer Composites Market : The global fiber reinforced polymer composites market size was valued at USD 104.19 billion in 2024 and is estimated to hit around USD 196.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.55% during the forecast period 2025 to 2034.

- Medical Fluoropolymers Market : The global medical fluoropolymers market volume was reached at 8.21 kilo tons in 2024 and is expected to be worth around 13.87 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 5.39% over the forecast period 2025 to 2034.

- Bio-Based Polymers Market : The global bio-based polymers market size was reached at USD 12.08 billion in 2024 and is expected to be worth around USD 58.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.06% over the forecast period 2025 to 2034.

- Lignin-based Biopolymers Market : The global lignin-based biopolymers market size accounted for USD 1.32 billion in 2024 and is predicted to increase from USD 1.38 billion in 2025 to approximately USD 2.07 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.

- Specialty Polymer Market : The global specialty polymer market volume was estimated at 17.71 million tons in 2024 and is predicted to increase from 19.25 million tons in 2025 to approximately 40.7 million tons by 2034, expanding at a CAGR of 8.67% from 2025 to 2034.

- Super Absorbent Polymer Market : The global super absorbent polymer market volume accounted for 4.16 million tons in 2025 and is forecasted to hit around 7.92 million tons by 2034, representing a CAGR of 7.43% from 2025 to 2034.

- Polymer Denture Material Market ; The global polymer denture material market size accounted for USD 2.49 billion in 2025 and is forecasted to hit around USD 4.11 billion by 2034, representing a CAGR of 5.75% from 2025 to 2034.

- U.S. Fluoropolymer Coating Market : The U.S. fluoropolymer coating market volume was reached at 23,400.0 tons in 2024 and is expected to be worth around 39,970.6 tons by 2034, growing at a compound annual growth rate (CAGR) of 5.50% over the forecast period 2025 to 2034.

- Europe Polymer Market : The Europe polymer market size was approximately USD 385.31 billion in 2024 and is projected to reach around USD 642.73 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 5.25% between 2025 and 2034.

- Asia Pacific Polymers Market : The Asia Pacific polymers market size was reached at USD 348.97 Billion in 2024 and is expected to be worth around USD 598.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.55% over the forecast period 2025 to 2034.

- U.S. Specialty Polymers Market : The U.S. specialty polymers market size was valued at USD 27.98 billion in 2024 and is expected to hit around USD 59.52 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.84% over the forecast period from 2025 to 2034.

- Asia Pacific Specialty Polymers Market : The Asia Pacific specialty polymers market volume stands at 8.98 million tons in 2025 and is forecast to reach 20.87 million tons by 2034, growing at a CAGR of 9.82% from 2025 to 2034.

-

U.S. Polymer Foam Market : The U.S. polymer foam market size was reached at USD 14.49 billion in 2024, grew to USD 15.17 billion in 2025 and is expected to be worth around USD 22.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.65% over the forecast period 2025 to 2034.

Polymer Foam Market Top Key Companies:

- BASF SE

- The Dow Chemical Company

- Huntsman Corporation

- Recticel S.A.

- Rogers Corporation

- Sealed Air Corporation

- Borealis AG

- Exxon Mobil Corporation

- Finproject Group

- Hanwha Solutions Chemical Division

- JSP Corporation

- Kaneka Corporation

- SABIC

- Sekisui Chemical Co., Ltd.

- Trocellen GmbH

Recent Developments

- In October 2025, the FOAMS conference was held in Nepal, Italy, which was sponsored by SPE’s Thermoplastic Materials & Foams division. This international conference brings industrial players together to present technical papers on innovations in new blowing agents, micro- and nano-cellular foams, sustainable foams, foam processing, foamed nanocomposites, and biodegradable foams.

- In November 2024, researchers at India’s premier institute have developed a bio derived foam made from non-edible oils and tea leaf extracts, aimed at packaging applications. This sustainable foam is engineered to degrade in hours under specific conditions, offering an alternative to traditional petroleum-based foams and reducing greenhouse gas emissions from packaging production. The innovation reflects growing pressure on manufacturers and brand owners to adopt eco-friendly materials.

Polymer Foam Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Polymer Foam Market

By Foam Type

- Flexible Foam

- Rigid Foam

By Resin Type

- Polyurethane Foam

- Polystyrene Foam

- Polyolefin Foam

- PVC Foam

- Phenolic Foam

- Melamine Foam

- Others (e.g., Polyethylene Foam, Polypropylene Foam)

By Cell Structure

- Closed Cell Foam

- Open Cell Foam

By Application

- Building & Construction

- Insulation

- Roofing

- Flooring

- Wall Panels

- Packaging

- Protective Packaging

- Food Packaging

- Industrial Packaging

- Furniture & Bedding

- Mattresses

- Cushions

- Pillows

- Automotive

- Seats

- Headliners

- Dashboards

- Door Panels

- Footwear

- Insoles

- Outsoles

- Sports & Recreation

- Sports Equipment

- Protective Gear

- Healthcare

- Medical Devices

- Orthopedic Supports

- Electronics

- Shock Absorption

- Insulation

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.