N.S. Lachman & Co. Launches $57.5 Billion Space Industry Consolidation Ecosystem, World's Largest Space-Focused Platform

N. S. Lachman & Co. LLC specializes in the space and aerospace sectors, utilizing a global workforce to capitalize on the multi-trillion-dollar space industry.

The space industry is too fragmented to profitably support a multi-trillion-dollar cis-lunar industry. Through the Space Industry Consolidation Partners fund, we'll unify the fragmented industry.”

ORLANDO, FL, UNITED STATES, January 27, 2026 /EINPresswire.com/ -- - The firm anchors a historic capital raise of $57.5 Billion, spread over four funds, with its own $575 Million (1%) General Partner Commitment, targeting investments in cis-lunar transportation systems and infrastructure, the consolidation of the space tech industrial base, and strategic equity acquisitions of private and public market leaders like SpaceX.— Neal S. Lachman, Chairman & CEO, N/SLachman & Co. LLC

- With the $57.5B capital, NSLachman & Co will execute a constructive activist investment strategy to catalyze strategic realignment and operational discipline within the space and aerospace sector, influencing corporate governance and capital allocation to unlock greater shareholder value and drive superior risk-adjusted returns.

- N. S. Lachman & Co. LLC (NSLachman & Co or the firm) specializes in the space and aerospace sectors, utilizing a global workforce and a contrarian market view to capitalize on the shifting funding dynamics of the multi-trillion-dollar space industry.

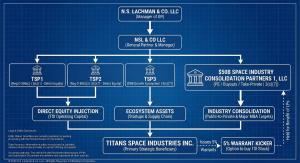

ORLANDO, FL – January 27, 2026 - N.S. Lachman & Co. LLC, a new global Merchant Capital and Corporate Strategy firm founded by space industry veterans, today announced the upcoming (Feb 14, 2026) simultaneous launch of four strategic investment vehicles totaling $57.5 Billion in capitalization. This integrated capital platform creates the largest space-focused funding ecosystem in the world, designed to finance the end-to-end industrialization of the cis-lunar economy, from the Titans Spaceplanes fleet to the consolidation of the global space and aerospace supply chain.

The ecosystem is managed by the firm's dedicated General Partner entity, NSL & Co. LLC, and is designed to finance the end-to-end industrialization of the cis-lunar economy -from the Titans Spaceplanes fleet to the consolidation of the global aerospace supply chain.

To underscore the firm's conviction, NSLachman & Co has authorized its own General Partner Capital Commitment of up to $575 Million across the ecosystem. This commitment ensures the firm maintains a significant, long-term pari-passu position alongside its Limited Partners, creating one of the most strongly aligned capital structures in the industry.

The Investment Ecosystem

The NSL & Co platform offers institutional investors a tiered "menu" of risk-adjusted exposure to the space economy:

- Titans Strategic Partners 1 & 2 ($2.5 Billion): The flagship Venture & Growth Special Purpose Vehicles providing direct equity capitalization for Titans Space Industries Inc. (TSI), the developer of the reusable Single-Stage-to-Orbit (SSTO) Titans Spaceplane.

- Titans Strategic Partners 3 ($5 Billion): A Growth Equity fund dedicated to acquiring and scaling the critical infrastructure, supply chain, and technology companies required to support the Titans ecosystem.

- Space Industry Consolidation Partners 1 ($50 Billion): A mega-cap Private Equity vehicle with a mandate to acquire, consolidate, and verticalize major publicly traded and private aerospace, defense, and industrial prime contractors

Strategic Mandate: SpaceX & Blue-Chip Tech Allocation

In addition to its consolidation strategy, the ecosystem has established a defined mandate to capture "Market Beta" in the premier sector leaders.

"To lead the space economy, we must invest in and operate the infrastructure of today while building the infrastructure of tomorrow," stated the firm's investment committee.

Accordingly, the Funds have allocated capital to:

- Acquire multi-billion dollar positions in SpaceX (Space Exploration Technologies Corp.) through private secondary markets and pre-IPO tenders, ensuring significant exposure to the current market leader.

- Execute strategic investments in other renowned, high-growth space technology companies that complement the Titans supply chain, creating a diversified portfolio of the industry's most critical assets.

Unprecedented Alignment

In an industry where investment managers often rely solely on fees, NSL & Co. has taken a distinct approach by anchoring the funds with significant at-risk capital.

"We are not just asset managers; we are the builders of the new space economy," said Neal S. Lachman, Founding Chairman & CEO of N.S. Lachman & Co. LLC. and Titans Space Industries Inc. "We believe that the best way to serve our sovereign and institutional partners is to sit on the same side of the table. Our $575 million commitment is a binding pledge that we share the exact same risk and reward as our investors. We are fully invested in this space industry consolidation roadmap."

Strategic Consolidation

The launch of Space Industry Consolidation Partners 1 LLC (SICP1) marks a shift from venture-style space investing to industrial-scale consolidation.

"The space industry is currently too fragmented to effectively and profitably support a multi-trillion-dollar cis-lunar industry," continued Neal Lachman. "Through SICP1, we intend to unify the fragmented industrial base, propulsion, materials, satellites, and next-gen spacecraft (from spaceplanes to spaceships to space tugs to space stations) under a single strategic infrastructure-building mandate. We are providing the capital intensity that the 21st-century space age demands. Without consolidation and concentration of assets and efforts in the coming years, most space companies will face major trouble."

Investment Thesis: The "Morgan Moment" for the New Space Economy

N.S. Lachman & Co. posits that the commercial space economy has reached a critical historical inflection point, comparable to the 19th-century "Railway Mania." Just as early American railroads suffered from a "fragmentation trap" - where hundreds of disjointed, incompatible lines destroyed capital- today’s "New Space" sector is plagued by thousands of isolated startups burning venture capital on redundant R&D and directionless, competing projects.

The firm argues that while innovation ignites a boom, only consolidation builds an industry. The current ecosystem of standalone propulsion labs and launch providers mirrors the "duplicate tracks" of the 1850s: technologically revolutionary but economically inefficient. To survive the capital intensity of spaceflight, the market requires a "Morgan Moment" - a necessary wave of consolidation similar to how J.P. Morgan unified the railroads into profitable networks.

This thesis underpins the strategy of Space Industry Consolidation Partners 1 (SICP1). By acquiring and integrating best-in-class technologies under one roof, and by directing public and private investees to cooperate and strategically align, NSLachman & Co. aims to replace the friction of vendor management and industry competition with the efficiency of vertical integration. The goal is to move beyond the chaotic startup phase and build the "Great Trunk Lines" of the 21st century -unified industrial giants capable of sustaining permanent cis-lunar infrastructure.

Example of project financing: Titans Works; From Space Nuclear Power and Propulsion to Deep Tech to Space Tech Research and Development

Space nuclear technology represents an unprecedented, systems-level effort to reconceptualize spaceflight, energy generation, and industrial infrastructure as a unified, integrated continuum rather than a collection of isolated technologies.

Spanning advanced nuclear power and propulsion systems, AI-supervised safety and control architectures, orbital operations, and global standards development, this body of work demonstrates that many capabilities traditionally regarded as “future” concepts are now technically addressable through disciplined engineering, rigorous feasibility analysis, and credible governance frameworks.

The program’s objective focuses on the deliberate development of scalable, auditable architectures capable of progressing from conceptual validation to operational implementation. Titans Works, which is aligned with Titans Space Industries Inc. as its R&D arm, will build upon this foundation through a coordinated portfolio of next-generation programs focused on the industrialization of space operations and energy systems.

Planned initiatives include AI-supervised nuclear and hybrid power stacks for orbital and planetary infrastructure; advanced materials and metamaterial systems for thermal protection, radiation mitigation, and structural resilience; programmable and self-healing technologies to support long-duration missions; and standardized architectures for orbital logistics, debris management, and in-space manufacturing.

In parallel, the organization will continue advancing safety, certification, and compliance frameworks aligned with international regulatory bodies, ensuring that technological innovation proceeds in lockstep with operational responsibility and global norms. Taken together, these current and planned programs establish the groundwork for a new class of space and energy systems that are safer, more resilient, and fundamentally industrial in scope. In doing so, Titans Works R&D is positioned not as a speculative research initiative, but as a platform for the practical development, commercialization, and governance of humanity’s next generation of off-world and high-energy infrastructure.

Dr. Robert W Mitchell, PhD, DBA, MCS, MBA, Senior Partner at N.S. Lachman & Co and Chief of R&D at Titans Space Industries Inc.:"The core of the Titans ecosystem’s vision is disciplined execution. Our team knows what's important: to move beyond speculative research and focus on the deliberate development of scalable, auditable architectures. The Titans Works R&D, particularly our Space Nuclear Project, is creating humanity’s next generation of off-world and high-energy infrastructure, spanning advanced propulsion, nuclear power, and AI-supervised systems for space and the Moon. We are researching, developing, and building the technologies and solutions for a sustainable, thriving, and growing cis-lunar civilization.”

Upon the full deployment of the initial four funds, or at the sole discretion of the Manager, N.S. Lachman & Co. LLC, the firm intends to organize a successor vehicle with a target capitalization of $100 Billion. This subsequent fund will be structured to significantly expand the investment mandate and strategic scope established by Space Industry Capital Partners 1 LLC (SICP1).

About N.S. Lachman & Co. LLC

N.S. Lachman & Co. LLC is a premier Merchant Capital and Corporate Strategy firm dedicated to the capitalization and industrialization of the multi-trillion-dollar space economy. Headquartered in Florida with a global network of partners, advisors, and analysts, the firm applies a contrarian investment thesis to identify high-value dislocations in the aerospace market.

Beyond capital allocation, N.S. Lachman & Co. LLC acts as a constructive activist investor, leveraging deep operational expertise to steer portfolio companies toward disciplined growth and superior risk-adjusted returns. To underscore its high-conviction outlook, the firm has authorized a General Partner Capital Commitment of up to $575 Million across its investment ecosystem, creating one of the most strongly aligned capital structures in the modern commercial space sector.

N.S. Lachman & Co. LLC is uniquely positioned not merely as a financial investor but as an active architect and principal driver of the multi-trillion-dollar cis-lunar economy. Anchored by the $57.5 Billion "Space Industry Investment Ecosystem," the firm has a clear mandate to invest in and direct the development of the entire industrial value chain. Their strategy moves beyond passive capital allocation by integrating a controlling ownership thesis with a profound technical and operational expertise. This is exemplified by their backing of the Titans Spaceplanes fleet and their plan for strategic consolidation, which gives them the necessary influence to execute large-scale, transformative projects across the aerospace and defense sectors, ensuring the capital is deployed with maximum strategic effect.

The firm's technical capability is channeled through its affiliated R&D arm, Titans Works. This organization focuses on moving past speculative research to the "deliberate development of scalable, auditable architectures" for humanity’s next generation of off-world infrastructure. This technical focus directly addresses high-value, complex challenges, including the technologies requested:

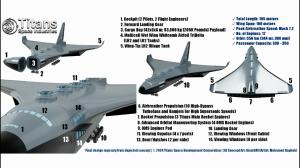

1. Spacecraft & Transportation

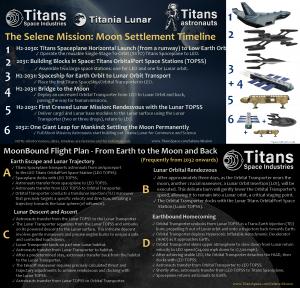

This vertical is defined by the direct equity capitalization of Titans Space Industries Inc. (TSI), the developer of the "Holy Grail" of aerospace: the reusable, Single-Stage-to-Orbit (SSTO) Titans Spaceplane. This extends to a broader fleet of next-generation vehicles, including the Orbital Transporters (from LEO to Lunar Orbit) and lunar landers.

Strategic Role: Establishes a sovereign-class logistics capability, drastically reducing the cost-per-kilogram to orbit and enabling reliable, airline-like access to cis-lunar space.

2. In-Space Manufacturing & Logistics

Under the Titans Works initiative, this sector moves beyond simple assembly to the industrial-scale production of high-value goods, materials, and products that cannot be created on Earth. By leveraging the unique properties of microgravity (such as the absence of sedimentation and convection), this vertical focuses on manufacturing superior fiber optics (ZBLAN), perfect protein crystals for pharmaceuticals, and advanced alloys.

Strategic Role: Transforms space from a destination into a production environment, generating high-margin revenue streams by exporting unique, space-made commodities back to Earth while utilizing in-situ resources to build infrastructure too large to launch.

3. Next-Gen Space Stations

This entails the deployment of the Titans OrbitalPort Space Stations (TOPSS) in Low Earth Orbit (LEO) and Lunar orbit. These habitats are designed as AI-supervised, self-sustaining ecosystems rather than temporary outposts.

Strategic Role: Provides the permanent commercial real estate necessary for the space economy to scale—serving as hubs for tourism, research, refueling, and transit between Earth and the Moon.

4. Space Nuclear Power (SNP)

The "Space Nuclear Project" focuses on the development of compact, high-density fission reactor systems and hybrid power stacks designed for the vacuum of space. Unlike solar, these units provide continuous, base-load power independent of orbital position or the 14-day lunar night.

Strategic Role: Serves as the reliable "always-on" energy backbone for industrial operations and life support, ensuring resilience where solar intermittency presents a critical failure risk.

5. Space-Based Solar Power (SBSP)

This initiativeinvolves the deployment of massive orbital arrays that harvest solar energy without atmospheric interference. This energy is beamed via microwave or laser transmission to rectennas on Earth, the Moon, or other spacecraft.

Strategic Role: Designed for scalable, gigawatt-level energy generation, acting as the primary renewable power source for the cis-lunar economy and a limitless export commodity.

6. Orbital & Lunar Data Centers

These are high-performance computing facilities located in orbit or on the lunar surface, supervised by advanced AI and cooled by the naturally cryogenic environment of space.

Strategic Role: Creates a decentralized "Space Cloud" essential for processing immense data streams—from space traffic management to financial transactions—locally, eliminating the latency of transmitting data back to Earth.

The unparalleled alignment, underlined by the firm's own $575 Million General Partner Capital Commitment, ensures that investor returns are the firm's highest priority. The leadership is comprised of space industry veterans who not only understand the technology but also the capital formation and consolidation required to transform fragmented sectors. Investors can and should rely on the deep expertise and principal commitment at N.S. Lachman & Co. to turn the $57.5 billion capital base into a superior return, with the potential to reach an outsized 10-20x multiple as the foundational industries of the cis-lunar economy are built.

www.NSLachman.com

NOTE: All websites and media are being updated

Legal Disclaimer & Safe Harbor

Forward-Looking Statements

This press release contains "forward-looking statements" regarding the development of Titans Space Industries Inc., its Single-Stage-to-Orbit (SSTO) technology, and the Titans Works industrial initiatives. These statements reflect current views with respect to future events and are subject to substantial risks, uncertainties, and assumptions. Actual results may differ materially due to regulatory hurdles (FAA/FCC), technological challenges in microgravity environments, and market volatility. N.S. Lachman & Co. LLC assumes no obligation to update these statements.

Regulatory Notice (Regulation D, Rule 506(c))

The investment opportunities described herein (Titans Strategic Partners 1 & 2) are offered pursuant to Rule 506(c) of Regulation D under the Securities Act of 1933. Public solicitation is permitted; however, the securities are available exclusively to Verified Accredited Investors. All potential subscribers must undergo independent verification of their accredited status prior to acceptance.

Investment Risk & Liability

Investments in the commercial space sector are highly speculative, illiquid, and involve a high degree of risk, including the potential loss of the entire principal. N.S. Lachman & Co. LLC acts as the Management Company and Activist Investor; it does not provide legal, tax, or investment advice. This communication does not constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction where such offer would be unlawful.

Media Contact:

Lachman Capital Partners LLC

media@lachmancapital.com

Investor Relations:

N.S. Lachman & Co. LLC

invest@nslachman.com

Sue Güvener - Communications Officer

N.S. Lachman & Co. LLC

media@lachmancapital.com

Visit us on social media:

LinkedIn

Neal S. Lachman's interview with Brooke Brown for The Space Intel Report

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.