Global Low-Lint Technical Yarns Market Projected to Reach USD 1.5 Billion by 2036 Amid Semiconductor and Aerospace Surge

Low-lint technical yarns market to total USD 0.7 billion in 2026, advancing to USD 1.5 billion by 2036, progressing at a CAGR of 7.9%.

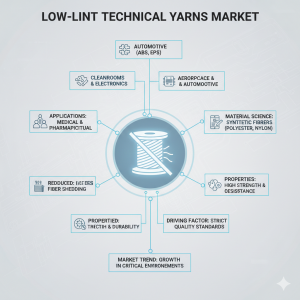

NEWARK, DE, UNITED STATES, February 6, 2026 /EINPresswire.com/ -- The global landscape for industrial textiles is undergoing a fundamental structural transition. According to a comprehensive new analysis by Future Market Insights (FMI), the global Low-Lint Technical Yarns Market is poised to reach a valuation of USD 1.5 billion by 2036, growing from USD 0.7 billion in 2026 at a steady CAGR of 7.9%.

This growth signals a decisive pivot from volume-driven production toward precision-engineered, contamination-controlled fiber solutions. As industries such as semiconductor fabrication, aerospace, and advanced defense systems adopt tighter purity standards, low-lint yarns have transitioned from discretionary textile inputs to critical enabling infrastructure.

Semiconductor Fabrication and AI Driving Precision Demand

The rapid expansion of sub-3nm and 2nm logic nodes, coupled with the global push for AI-driven chip production, has placed unprecedented pressure on cleanroom environments. In facilities operating at ISO Class 5 standards and below, microscopic lint release is no longer an inconvenience—it is a catastrophic risk to yield and operational stability.

"The industry is witnessing a clear move away from volume-led growth toward precision-engineered platforms," states an FMI lead analyst. "Competitive advantage is consolidating around suppliers capable of delivering filament-level control and validated low-shedding behavior across repeated use cycles."

Request For Sample Report | Customize Report | Purchase Full Report

https://www.futuremarketinsights.com/reports/sample/rep-gb-31851

Strategic Corporate Realignment and Divestitures

Major market participants are aggressively restructuring to capture high-margin technical segments. A landmark move occurred in late 2025 with the formal spin-off of Solstice Advanced Materials (formerly a Honeywell division), now a pure-play specialty materials entity focused on semiconductor manufacturing and defense applications.

Simultaneously, Indorama Ventures has advanced its "IVL 2.0" strategy, a three-year transformation (2024–2026) aimed at building a leaner, more agile enterprise. By rationalizing legacy assets and focusing on operational excellence, the company is positioning its fiber segment to capitalize on the "lifestyle and industrial" shift toward high-performance technical applications.

Sustainability Meets Industrial Performance

The innovation roadmap for 2026 is defined by the convergence of ESG mandates and mechanical durability. Teijin Frontier recently unveiled a product roadmap highlighting recycled polyester yarns that replicate the tactile properties of natural fibers while maintaining the high-tenacity, low-fibrillation characteristics required for cleanroom garments. This allows manufacturers to meet stringent circularity goals without compromising the purity of the controlled environment.

Regional Dynamics: China and the USA Lead the Vanguard

The geographical evolution of the market reflects the broader "reshoring" and "self-sufficiency" trends in high-tech manufacturing:

• China (7.9% CAGR): Consolidating its role from a volume exporter to a precision supplier, China is upgrading domestic capacity in carbon and conductive yarns to serve the Yangtze River Delta’s expanding semiconductor clusters.

• United States (7.4% CAGR): Growth is fueled by federal incentives for fabrication facilities and the implementation of Extended Producer Responsibility (EPR) frameworks, which favor domestic suppliers with auditable, traceable supply chains.

• Brazil (7.5% CAGR): Emerging as a regional hub for industrial textiles, Brazil is leveraging its healthcare and automotive base to diversify beyond apparel into medical-grade technical yarns.

The Competitive Frontier: A Qualification-First Regime

Entry into the low-lint technical yarn sector is increasingly governed by a "permission to supply" model. High-specification players like Toray Industries have successfully entrenched themselves by designating semiconductor materials as a Core Growth Business. For these leaders, competition is driven by system lock-in and multi-year qualification cycles that protect margins and insulate them from commodity-priced competitors.

Newer entrants are finding success through specialized innovation, such as RadiciGroup’s RENYCLE® recycled nylon, which integrates polymer recycling directly into the yarn platform to ensure impurity control matches the requirements of EU-regulated industrial buyers.

Outlook

The low-lint technical yarns market has moved past its identity as a textile sub-sector. In 2026, it stands as a specialized materials category where performance is measured in microns and success is tied to the growth of the global digital and aerospace economies. For investors and decision-makers, the sector offers a rare combination of non-discretionary recurring demand and high-barrier-to-entry technological moats.

Similar Industry Reports

Low Yellowing White Technical Yarns Market

https://www.futuremarketinsights.com/reports/low-yellowing-white-technical-yarns-market

Chemical-Splash Resistant Coated Technical Textile Yarns Market

https://www.futuremarketinsights.com/reports/chemical-splash-resistant-coated-technical-textile-yarns-market

Technical Films Market

https://www.futuremarketinsights.com/reports/technical-films-market

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.